It feels like quite a long time since we wrote last week, so this note is more of a summary of what we have actually been doing in Tenax over the past four weeks since the pandemic panic hit markets.

I think it is widely appreciated amongst our investors that Tenax entered this period with a cautious disposition (some were saying that we were being too cautious). By way of summary, this position was a response to what we saw as expensive debt and equity markets and not reflective of any great prescience as to the spread of COVID-19.

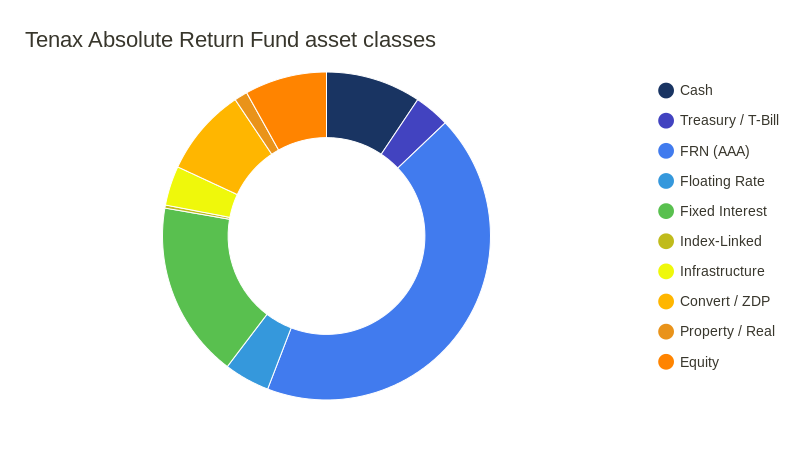

Our greatest concern as we went into this period of chaotic markets was to preserve actual cash resources, to be able to take advantage of opportunities as they arose, and to avoid getting caught in a (lack of) liquidity trap. The pie chart, see right, shows our disposition today, followed by some commentary for the broad sectors.

Cash and UK Treasury

We raised the actual cash level to around 13%, up from 8% at the end of February. This was achieved by sale of three of the floating rate note (FRN) positions (Leeds, Nationwide and Yorkshire Building Society issues), along with the redemption of a JPMorgan USD floating rate note that we held. Cash is the best diversifier and insurance in febrile markets when there is the added risk of disruption and illiquidity in the market-place.

Floating Rate Notes (FRN)

Following the sales noted above, our weighting here is down to 43% from 47% at the end of February. This is not to say that we are unsure about FRN now, they continue to offer attractive returns and risk/reward characteristics, simply adding to our flexibility as above.

Equity

Jumping across to the opposite end of the risk spectrum, equities, as this is where there have been the largest number of transactions in the Fund’s portfolio. The S&P 500 and FTSE 100 both broke down on 24th February and, by the Ides of March, had both fallen around 36% from their January highs.

Writing now, we have seen a modest recovery from the extremes of last week and it feels that FTSE 100 might have ‘found a floor’ around the 5000 level. I say ‘feels’ as nothing is certain in this climate. But there is no doubt that there is value on offer in a number of areas and we feel that it is the time to be re-building our exposure. I am quite sure that we will not hit the bottom in a number of the stocks but experience has taught us that we must build positions when all around are fearful, it will be too late by the time we are all relaxing again.

Our weighting to equities is now 8.1%, up from 6.8% at the end of February, which feels like a bit of an understatement as stocks have fallen so far. Among the direct investments, we have been focused on building or adding to positions in higher quality companies, which we feel are the most likely to return to favour and the least likely to suffer lasting damage from the inevitable economic slowdown that is coming. Holdings that we have been building-up as prices came back include: Diageo, Halma, William Morrison, Royal Dutch Shell, Smith & Nephew and Unilever. We have also re-instated our holding in Berkshire Hathaway (that we sold last summer).

Another area that began to reflect a shift in sentiment, from calm to panic, as equity markets came back, was closed-ended Investment Trusts. Notably last week, these came under sustained selling pressure, driving their share prices down faster than their actual underlying asset values. This presented opportunities in a number of the major trusts, notably AVI Global, Caledonia, F&C and RIT Capital.

Fixed Interest

Our weighting here is little changed overall (17.4% from 18%), though we have begun to make some additions over the past few days as conditions became calmer. The credit markets have moved broadly in-line with equities, with spreads widening from the end of February until late last week. With the sheer weight of (welcome) support from central banks, there has been a modest shift back to normalcy and even a few new issues to demonstrate this. The most interesting of these being an issue from Diageo yesterday of new 2.875% stock due in 2029, which came on a spread of 255bp over the gilt. We participated in this issue and have also picked-up some existing issues from Credit Suisse and Nationwide.

Infrastructure

Last week presented something of a ‘perfect storm’ for a long-only multi asset fund as all asset classes were hit, infrastructure was no exception. Having started the period relatively steadily, the various stock prices broke with a vengeance last week under major selling pressure, reminiscent of what was happening in the investment trust market. We have bought back the HICL Infrastructure that we sold in January and have added to our holdings in BBGI and Gresham Energy Storage.

As we mentioned last week, Jerry and I are perfectly used to working from remote locations so the current strange circumstances do not present us with any practical problems. We hope that all are keeping well.

How would you like to share this?