The Esk Global Equity Fund enjoyed another strong quarter, the B shares rising by 3.65% compared to a rise in the IA Global sector average of 2.93%.

The second quarter of the year in equity markets has been dominated by technology stocks and, in particular by a narrow range of major US companies. The broad world indices (in sterling) have gained around 3% but this is dominated by an 11% gain for the NASDAQ and 7% gain for the S&P 500, also pulled up by those major technology stocks. Japanese stocks have been the other feature as their recovery gathered pace, the TOPIX gaining 16%. In contrast, London stocks slipped down while Chinese stocks weakened, notably in Hong Kong where the Hang Seng fell by 7%.

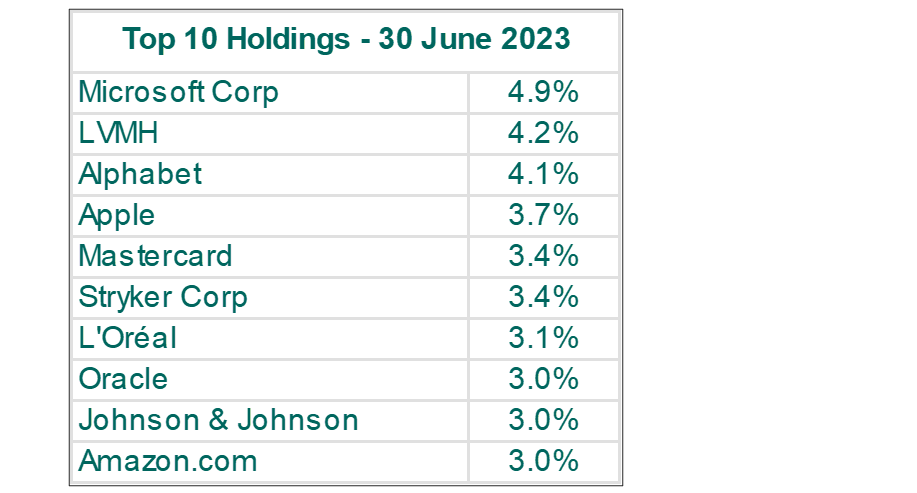

Positive contributions came from the big tech holdings. Alphabet, Amazon, Apple, and Microsoft all of which gained by 15% or more and a notable contribution from Oracle, which has leapt in to our top ten with a 27% gain over this period. In mid-June, we reduced the Microsoft holding a shade (it had gone over 5% of the portfolio and gained 40% over the year to date) and similarly Oracle, which we reduced by around 10% after their move. The other top ten holdings were quieter, notably the French luxury goods companies, but all contributed.

Otherwise, we saw a decent recovery in Chugai Pharmaceutical and in GN Store Nord (though this one has a way to go to justify us retaining it). Ferrari had another good quarter, gaining 20%, and is only just outside the top ten holdings now. Amongst the financial holdings, Sumitomo Mitsui Financial had a good quarter (as did all the Japanese holdings) and we significantly reduced the holding in Morgan Stanley in favour of adding a new holding in Standard Chartered, which looks anomalously good value in an international context. This latter switch has proved to be profitable so far, we will look to do more if we get the opportunity again.

Detracting from overall performance of the Fund this quarter has seen the continued recovery in sterling v. the US dollar. Amongst the individual stocks the detractors were: Novozymes and Rio Tinto fell back and, in a generally dull Staple Goods sector, Heineken and Nestlé slipped, and particularly dull were Rémy Cointreau, which fell after the French distiller reported slowing revenues over its fourth quarter. Also weaker were the two reinsurance holdings, Everest Re and Swiss Re in a tricky quarter for insurers generally. Among the smaller holdings we had two disappointments, Sartorius reported poor first quarter figures in April and then cut their forecasts further in early June. Logitech reported lower sales in early May as expected (the shares rose on the news), but the abrupt departure of their Chief Executive in mid-June was not good. We sold both of these latter holdings.

*****************************************

Esk Objective and Policy

- Long-term capital growth

- From an international equity portfolio

- Actively managed portfolio of 40/50 holdings

- Strong bias to quality and growth

- Aim to buy-and-hold for the long-term

- Aware of 'benchmarks' - but do not follow them

- Developed markets only (Rule of Law)

A few things Esk does not do:

- No emerging market stocks

- No smaller companies

- No unquoted companies

- No 'un-profitable tech'

- No shorting...

- No 'regional' banks

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?