Having taken a holiday over the end of last month, this commentary covers a period of almost eight weeks since early May. It also takes us close to the end of the first half of the year. It has been quite a period.

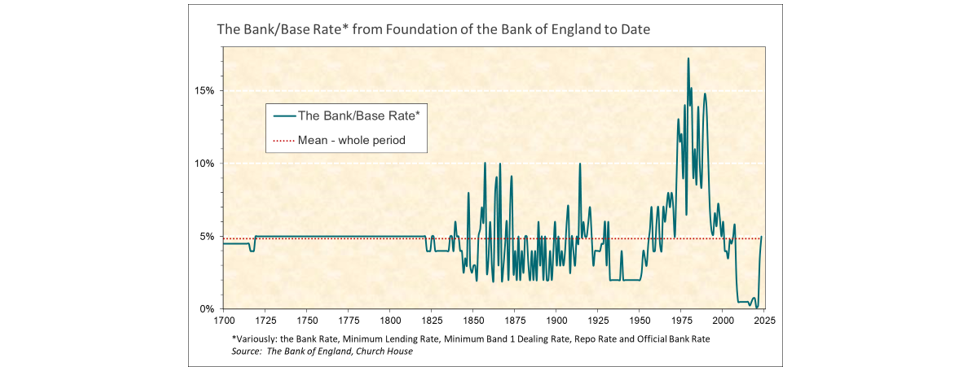

The Bank of England has moved the base rate up a further75bp to 5%, a level not seen since 2008, as the inflation figures remained stubbornly high. Which leads me to the first chart, the base rate back to the foundation of the Bank, showing the rate snapping neatly back to its (very) long-term average and redressing what had always looked like an anomaly of a period, right.

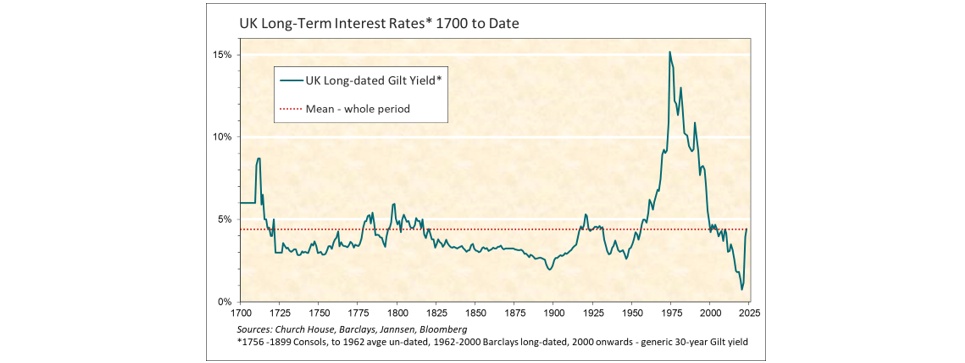

The Gilt market has followed suit with some steep falls, taking the ten-year yield back up to 4.4%, also a level not seen since 2008. But note that the yield curve is steeply inverted now with one-year Gilt yields at 5.3%, ten-year as above and even lower for the ultra-long dates. This too is a generational shift in rates and our chart of long-term (thirty year) yields shows a similar pattern to base rates with the yield returning to its long-term average and marking a savage end (?) to the long bull market in fixed interest, right.

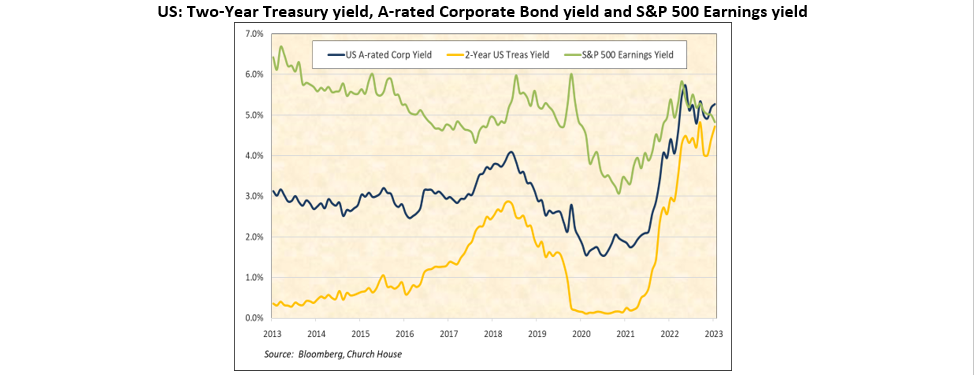

This generational shift in rates has profound implications for asset allocators. Essentially, the Gilt and fixed interest markets look so much more attractive now that they have shouldered their way back into consideration. ‘Balanced’ portfolios can properly return to the fore and income seeking investors can heave a sigh of relief. The open question is the extent to which this undermines the case for equities. This is most satisfactorily illustrated in the following chart of US Treasury and investment grade corporate bond yields v. the earnings yield on the S&P 500 over the past ten years, right.

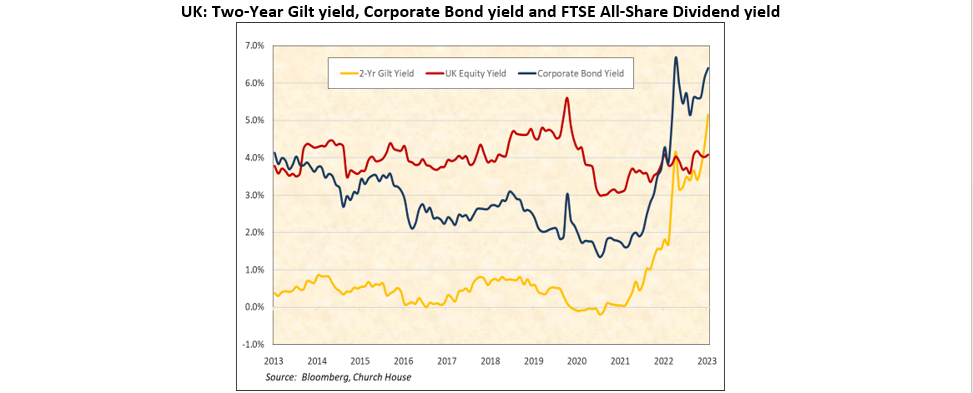

The picture for the UK does not illustrate the point quite so satisfactorily, though the pattern is the same. Note that this charts the dividend yield for the UK, not the earnings yield, which is quite distorted by some of the major companies (though it does make the UK equity market look cheap in an international context), right.

The US Federal Reserve had led the way to higher rates and has since paused at 5.25% in early May, waiting (sensibly) to see how the effects of the steep increases over the year wash through the economy. But they are stressing that they won’t hesitate to go further… The ECB is still on a path to higher rates, but then they were the last to get going. Inflation has fallen back satisfactorily in America and, to a slightly lesser extent in Europe, the UK remains a rather depressing outlier though this too should fall back more noticeably over the second half.

Equity markets have been distinctly mixed over the period. Leading the pack again has been the NASDAQ with an 11% gain, buoyed by AI speculation and a narrow band of stocks, most notably Nvidia, which jumped 46%. American stocks were generally firmer, the S&P 500 gained 6% but, again, most of it was down to a narrow band of technology stocks. There were a surprising number of decliners including: Colgate-Palmolive, Kimberley-Clark, Coca-Cola and Pepsico, a pattern which was repeated in other markets with falls for Unilever, Diageo and Nestlé. The UK fell back (to where it started the year) as did most European markets.

The Far East saw sharp contrasts, Chinese and Hong Kong stocks fell, but Japan put in another strong performance. Japan was bolstered again by further purchases of the trading houses by Warren Buffett’s Berkshire Hathaway but the move was broad: Panasonic gained 30%, Toyota Motor 24%, Mitsubishi UFJ Financial, Recruit Holdings and Shin-Etsu Chemical all 20% plus.

The price of oil sank further (despite more production cuts) and is now down by around 15% over the year, all quite encouraging for the inflation figures. This was reflected in the performance of ‘big oil’: BP, Chevron, TotalEnergies and Exxon Mobil all slipped back.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?