Finally, some better news for the UK on inflation.

After spending months struggling in the rearguard of the fight against inflation, today’s figures (CPI at 7.9% annual and ‘core’ at 6.9%) are to be welcomed. We still lag a long way behind the rest, US inflation figures came in at 3% (also better than expected) while the eurozone is running at around 5.5%.

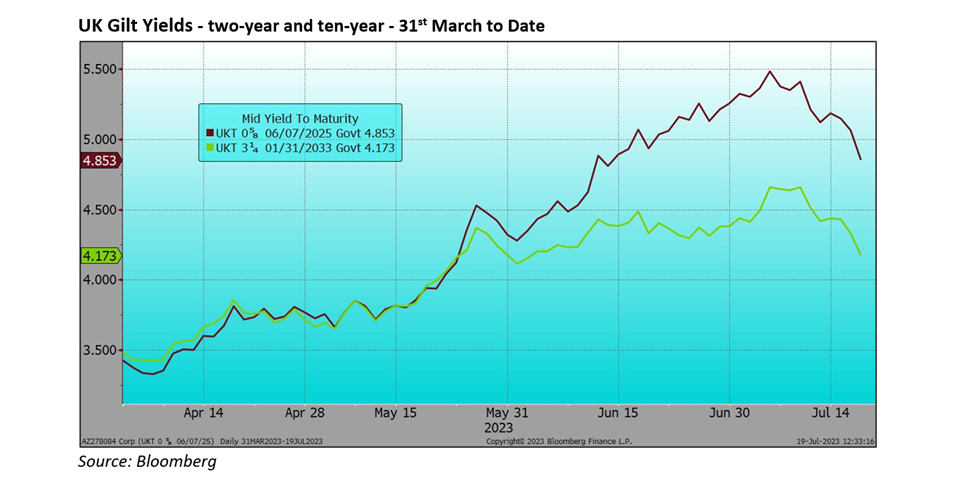

But markets had been in maximum depression mode, just two weeks ago a move to a Base Rate of 6.5% had been priced in and Gilt / other fixed interest prices had really been struggling. The US inflation figures had tempered this, today’s figures are pushing rates lower again, right.

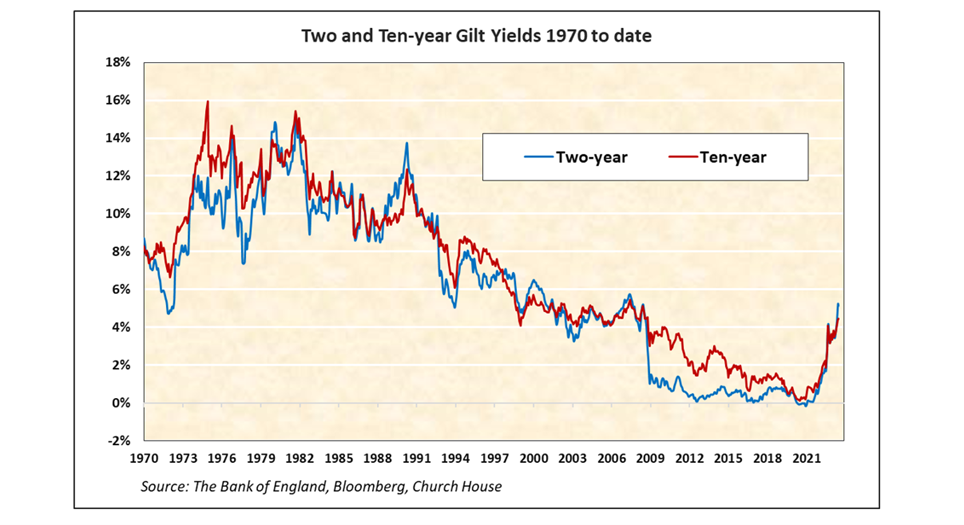

As the chart shows, short-term yields moved up progressively through June and created an ever-steeper yield curve as longer rates did not move as far or as fast. A curve this steep is unusual, it is frequently cited as a warning signal for a recession to come. Our long-term chart (from 1970) of two and ten-year yields shows how unusual this is and indicates that this big a gap between the two (steep yield curve) nearly always foreshadows a change in direction for rates, right.

The recent figures do take some pressure off the Bank of England, who, hopefully, can now restrict the expected August move up in Base Rates to ¼%. I hope this is right as there seemed to be a mounting risk that a beleaguered Bank was going to push rates to extreme levels and do some real damage to the economy rather than exercising some patience to see quite how much damage has been done already.

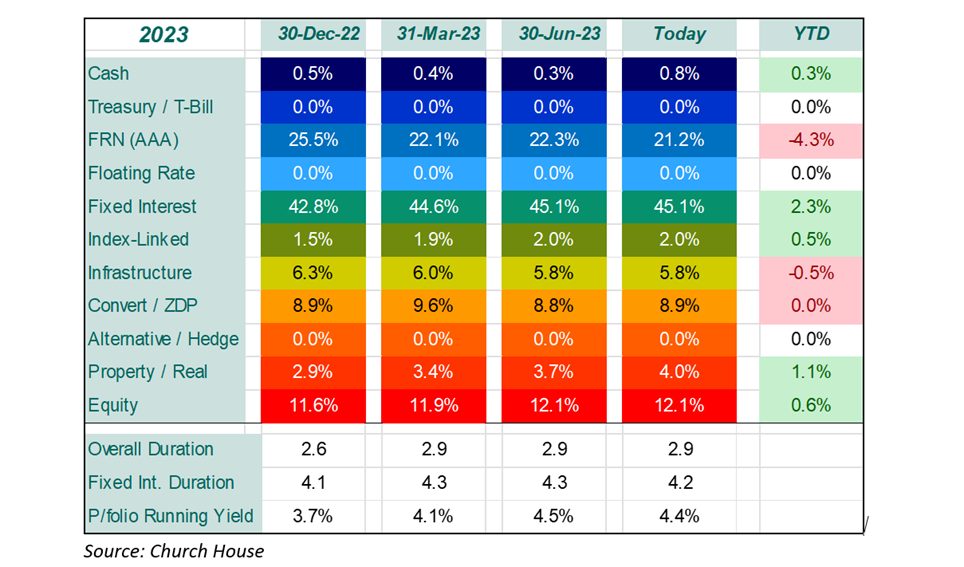

The asset mix within the Fund, shown below, is little changed since the end of June and clearly reflects our bias towards the value on offer in fixed interest markets. As we said last time, we can’t be certain when the current pressure on rates will subside, but the short time to maturity of these bonds and their high redemption yields gives us a high degree of confidence in the returns. If today’s move in the bond markets holds, this will quickly be reflected in prices, right.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?