As we noted in April “terminal rates are in sight”. The US Federal Reserve led the way (again) with a quarter point increase in rates to 5.25% but signalled a likely June pause.

Having raised the Fed Funds rate by 5% since last March, witnessing some turmoil in regional banks and a distinct tightening in credit conditions, the Fed clearly judges (correctly) that it is time to wait and see what else breaks. We suspect that this is probably the top for US rates but do not expect an early move down again, holding here for six months looks more likely. Of course, a failure to sort the annual debt ceiling shenanigans could throw all sorts of problems into the mix.

The European Central Bank (ECB) duly followed suit with a quarter point increase in rates as did the Bank of England. The ECB appears likely to carry on further (still catching up) while the Bank of England is likely done now though a further quarter point is possible if April’s inflation figures fail to deliver a decent improvement (it would be very odd if they didn’t). Ten-year Gilt yields have come down a shade over these four weeks though at 3.8% they are still noticeably higher than US ten-year yields at 3.5%. Longer-dated Gilt yields have edged higher again, the price of the long Gilt (thirty year) has now fallen 11% from early February levels.

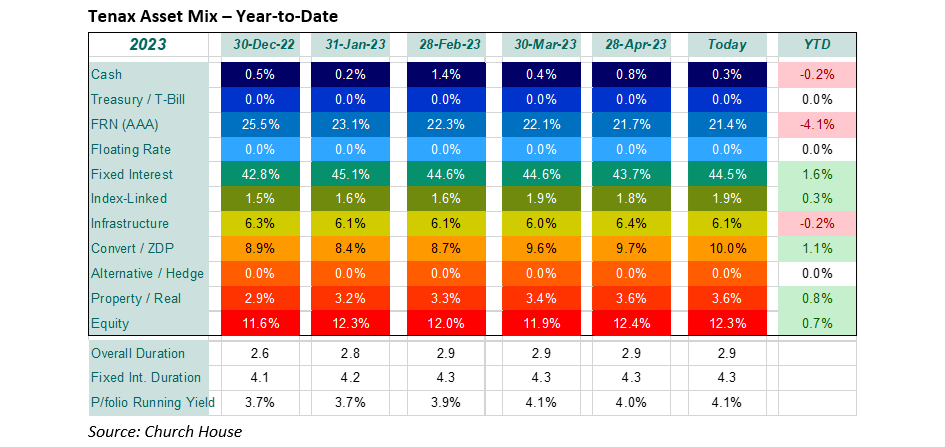

The focus of the Fund continues to edge further towards sterling credit markets (UK fixed interest), moving gradually from floating to fixed rate, but still concentrating on the short-dated end of the market (right.

The overall duration, and the duration of the fixed interest proportion, is unchanged over this period. The running yield from the portfolio continues to increase (and will move higher yet) with higher interest from the floating rate book and the attractive returns we are picking-up in credit.

It has been a quiet period overall for equity markets with most leading indices down one to two per cent but further gains for the tech stocks that dominate the NASDAQ and for Japan. The equity positions in the Fund show encouraging gains for the ‘quality’ companies again, Halma being a feature over this period, though it is surprising to see a small fall for Diageo despite the announcement that Warren Buffet’s Berkshire Hathaway has established a stake in the company. Banks remain under a cloud, and we have seen some weakness in Lloyds and Standard Chartered. We are rebuilding some exposure to private equity, which we had sold out of in October 2021, with purchases of ICGT Enterprise, which now look startlingly good value after good figures.

The property holdings were mixed with good results from Segro encouraging a 5% rally in their stock, similarly solid results from Land Securities left their stock unchanged. The (small) holding in Freeport-McMoRan fell back with a general decline in metals prices (worrying about the potential for a US recession and the pace of recovery in China). In infrastructure, we took some profits from the holding in Gresham House Energy Storage, which had done well for the Fund, and were pleased to see some recovery in SDCL Energy Efficiency (which still looks too lowly priced!)

The Fund feels well placed at this stage of the cycle; we continue to feel that short-dated sterling credit is very attractive at current levels and the balance feels right. The drop back in volatility in the Fund is welcome and we expect this to persist.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?