To start with an appalling cliché, October was a month of two halves for UK markets.

London assets, from equities, to Gilts, to sterling, were battered by the circus that turned out to be Liz Truss’ premiership in September and early October, before calm set in on the announcement of Rishi Sunak as our new Prime Minister. While Rishi has announced little in terms of his plans, the fact is that financial markets have materially more faith in him than they did in Liz Truss and this has already bought him time to build what we all hope will be a more thought-out and fiscally achievable Autumn Statement than the mini budget that is thankfully behind us now. One can see in the reaction of risk assets, that the market is relieved with the appointment of our new PM and anticipates a measured hand at the tiller – sterling has bounced off multi-decade lows, gilt yields have moderated and corporate bond spreads have begun to tighten. I must reiterate that the damage done to UK assets has not been entirely fixed and it will take time for our international credibility to be restored, but there are at least some positive foundations being put in place during the first few weeks of PM Sunak’s leadership.

US and European markets performed strongly in October, with the Euro Stoxx 50 +10% and the Russell 2000 (a wider index of US small and mid-caps) +11%. One has to hope that against the context of calmer domestic politics, UK assets can recover some of this lost ground in the months ahead. Yes, the FTSE 100 has in fact outperformed other global indexes in 2022 thanks in large portion to its heavy weighting to oil and gas majors, but one look at the FTSE 250 or AIM markets in 2022 will tell you that the FTSE 100 is a narrow and not especially reflective indicator of UK equity markets as a whole.

Inflation and interest rates are dominating market sentiment at present and, while the headline figures remain somewhat alarming, it has been heartening to see an increasing number of macro readings and comments from individual businesses that point to some moderation in the Cost of Living Crisis (as named by the BBC). To pick three high-profile examples:

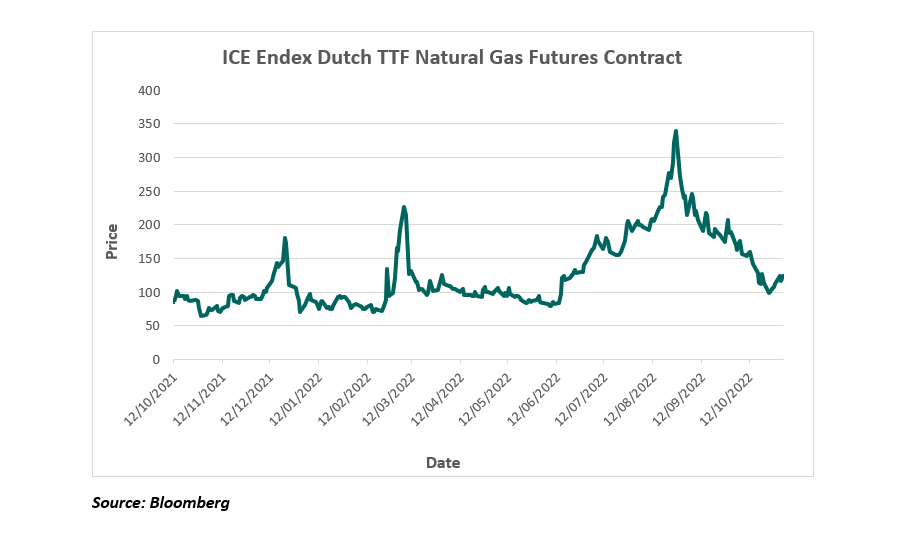

- Despite Putin’s best efforts, the EU natural gas price has fallen by almost two thirds since peaking in late-summer (see chart).

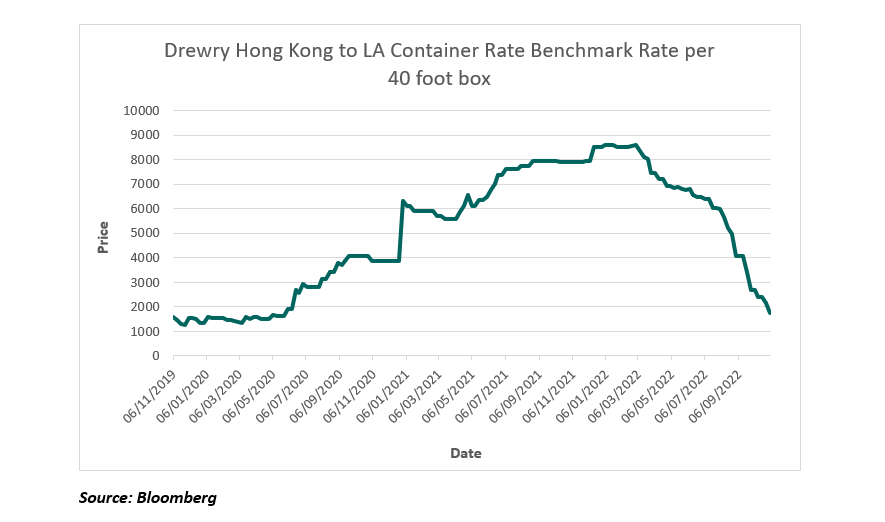

- Freight rates on some routes are back down to pre-COVID levels (see chart) and we heard AP Moller-Maersk predicting further declines in rates at their latest results.

- Unilever commented at their recent results that they are beginning to see commodities ‘soften from their peaks’.

We are undoubtedly going through tougher times and individuals are likely to feel the pain of the current economic conditions hardest, but our conviction is that markets have already moved to price this in and that we have seen the worst of the inflation/rates-induced market volatility for the time being. Next time we write we hope to be commending a sensible and achievable Autumn Statement and another month of improved confidence in UK markets.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?